In the bustling city of Killeen, Texas, navigating the roads requires a reliable insurance plan. Enter car insurance killeen tx, your comprehensive guide to understanding coverage options, comparing providers, and uncovering money-saving strategies. Buckle up and let’s dive into the world of car insurance in Killeen, TX.

From liability to comprehensive coverage, we’ll explore the nuances of each option, empowering you to make informed decisions. We’ll also uncover the factors that shape your premiums, such as driving history and vehicle type, providing you with insights to optimize your coverage.

Car Insurance Coverage Options in Killeen, TX

Car insurance in Killeen, TX, offers various coverage options to protect drivers and their vehicles. Understanding these options is crucial for choosing the right policy that meets individual needs and financial capabilities.

In Killeen, Texas, car insurance is essential for protecting your vehicle against unforeseen events. While most policies cover common risks like collisions and theft, it’s important to consider comprehensive coverage to safeguard against vandalism. Does car insurance cover vandalism ?

Yes, comprehensive car insurance typically covers malicious damage to your vehicle, providing peace of mind in the event of intentional acts of destruction.

The primary coverage options available in Killeen, TX, include liability, collision, comprehensive, and additional coverages. Each option provides specific benefits and limitations, as explained below:

Liability Coverage

- Covers damages or injuries caused to others in an accident where the policyholder is at fault.

- Includes bodily injury liability, which covers medical expenses and lost wages of injured parties, and property damage liability, which covers damage to property belonging to others.

- State laws determine minimum liability coverage requirements, but higher limits are recommended for increased protection.

Collision Coverage

- Covers damages to the policyholder’s own vehicle in an accident, regardless of fault.

- Provides financial assistance for repairs or replacement of the damaged vehicle.

- Deductible applies, which is the amount the policyholder pays before coverage takes effect.

Comprehensive Coverage

- Covers damages to the policyholder’s vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Provides financial protection against non-collision-related losses.

- Deductible also applies, similar to collision coverage.

Comparing Car Insurance Providers in Killeen, TX: Car Insurance Killeen Tx

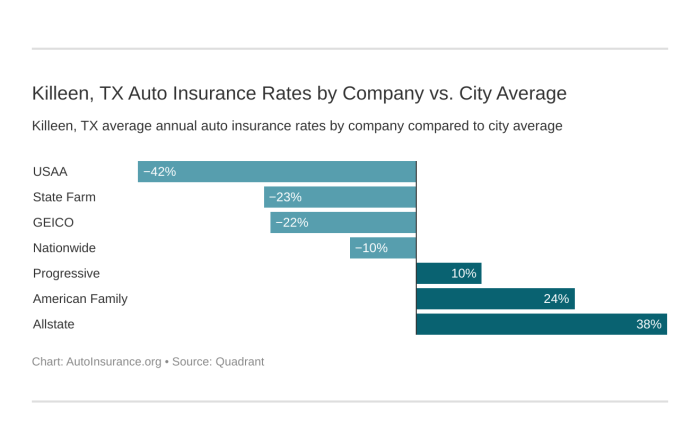

When choosing car insurance in Killeen, TX, it’s crucial to compare different providers to find the best coverage and rates. Here’s a comprehensive comparison of the top insurance companies in Killeen, TX:

| Provider | Coverage Options | Premiums | Customer Service | Discounts |

|---|---|---|---|---|

| State Farm | Comprehensive, collision, liability, uninsured motorist, personal injury protection | Competitive rates | Excellent customer satisfaction ratings | Multiple discounts, including safe driver, good student, and loyalty |

| Progressive | Similar coverage options to State Farm | Competitive rates, often lower for high-risk drivers | Good customer service, but not as highly rated as State Farm | Various discounts, including Snapshot program for usage-based pricing |

| GEICO | Comprehensive, collision, liability, uninsured motorist, roadside assistance | Typically lower rates than State Farm and Progressive | Average customer service ratings | Discounts for military members, federal employees, and students |

| Allstate | Comprehensive, collision, liability, uninsured motorist, rental reimbursement | Higher rates than other providers | Good customer service, but not as highly rated as State Farm | Discounts for safe driving, multiple cars, and good credit |

| USAA | Exclusive to military members and their families | Competitive rates for military members | Excellent customer service, specifically tailored to military needs | Discounts for military service, safe driving, and multiple cars |

Consider these factors when comparing providers:

- Coverage options: Ensure the provider offers the coverage you need.

- Premiums: Compare quotes from different providers to find the best rates.

- Customer service: Look for providers with high customer satisfaction ratings.

- Discounts: Take advantage of discounts offered by providers to save money.

Tips for Saving Money on Car Insurance in Killeen, TX

Car insurance premiums can vary significantly depending on various factors. In Killeen, TX, there are several practical tips you can follow to reduce your insurance costs:

Maintain a Good Driving Record

- Avoid traffic violations, such as speeding tickets or accidents, as they can increase your insurance premiums.

- Consider taking a defensive driving course to improve your driving skills and demonstrate your commitment to safe driving.

Shop Around for Quotes

- Compare quotes from multiple insurance companies to find the most competitive rates.

- Use online comparison tools or consult with an insurance agent to get quotes from different providers.

Bundle Insurance Policies

- Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to discounts.

- Insurance companies offer package deals that can save you money on multiple policies.

Increase Your Deductible, Car insurance killeen tx

- Raising your deductible, which is the amount you pay out of pocket before insurance coverage kicks in, can lower your premiums.

- However, it’s important to choose a deductible that you can afford to pay in case of an accident.

Take Advantage of Discounts

- Many insurance companies offer discounts for certain factors, such as having a good credit score, being a safe driver, or owning a car with safety features.

- Inquire about available discounts to see if you qualify for any savings.

Other Tips

- Consider using public transportation or carpooling to reduce your annual mileage, which can impact your premiums.

- Install anti-theft devices in your car, such as an alarm or immobilizer, which can lower your risk of theft and potentially reduce your insurance costs.

Local Resources for Car Insurance in Killeen, TX

Killeen, Texas, residents have access to various local resources that can assist them with their car insurance needs. These resources include insurance agents, brokers, and government agencies.

Insurance Agents

- Insurance agents are licensed professionals who represent insurance companies and can help you compare policies and find the best coverage for your needs.

- To find an insurance agent in Killeen, you can use online directories or ask for recommendations from friends or family.

Insurance Brokers

- Insurance brokers are independent agents who work with multiple insurance companies and can offer you a wider range of options.

- Insurance brokers can be helpful if you have a complex insurance situation or if you are looking for a specific type of coverage.

Government Agencies

- The Texas Department of Insurance (TDI) regulates the insurance industry in Texas and can provide you with information about car insurance laws and regulations.

- The TDI also has a complaint system that you can use if you have a problem with your insurance company.

Query Resolution

What are the minimum car insurance requirements in Killeen, TX?

Texas requires drivers to carry liability insurance with minimum limits of $30,000/$60,000 for bodily injury and $25,000 for property damage.

How can I find affordable car insurance in Killeen, TX?

Shop around for quotes from multiple insurance providers, maintain a clean driving record, and consider bundling your insurance policies to save money.

Car insurance Killeen TX can vary depending on the type of vehicle you drive. For instance, if you own a Toyota, you may want to consider exploring toyota car insurance. Toyota car insurance is designed specifically for Toyota vehicles and may offer additional benefits and discounts that can save you money.

However, it’s always a good idea to compare quotes from multiple insurance companies to find the best rate for your needs.

If you’re in the Killeen, TX area and need car insurance, be sure to compare quotes from multiple providers to find the best deal. You can also learn more about does urgent care bill you later with insurance to help you make informed decisions about your healthcare coverage.

Once you’ve found the right car insurance policy, you can drive with peace of mind knowing that you’re protected.

When looking for car insurance in Killeen, TX, it’s important to compare quotes from multiple providers to find the best rate. You can also consider bundling your car insurance with other policies, such as homeowners or renters insurance, to save even more money.

If you’re looking for cheap car insurance in a different city, such as Tucson, AZ, be sure to check out our guide to cheap car insurance tucson. With a little research, you can find the right car insurance policy for your needs and budget in Killeen, TX.

Car insurance in Killeen, TX is essential for protecting your vehicle and yourself in case of an accident. However, if you don’t own a car but still need coverage, you may want to consider non owner car insurance california.

This type of insurance provides coverage for drivers who don’t have a car registered in their name but still need to operate a vehicle. It can be a great option for those who rent cars, borrow cars from friends or family, or use car-sharing services.

If you’re looking for car insurance in Killeen, TX, be sure to consider all of your options, including non-owner car insurance.