With estimated car payment insurance cost on 2020 Chevy Silverado at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling semrush author style filled with unexpected twists and insights.

The content of the second paragraph that provides descriptive and clear information about the topic

Estimated Car Payment and Insurance Cost

The cost of a 2020 Chevy Silverado can vary depending on several factors, including the trim level, engine, and options chosen. Additionally, insurance costs can also vary based on the driver’s age, driving history, and location.

Estimated Monthly Payments

The estimated monthly payment for a 2020 Chevy Silverado can range from $400 to $800, depending on the factors mentioned above. For example, a base-level Silverado 1500 with a V6 engine and rear-wheel drive has an estimated monthly payment of around $400. On the other hand, a fully loaded Silverado 2500 with a V8 engine and four-wheel drive could have an estimated monthly payment of around $800.

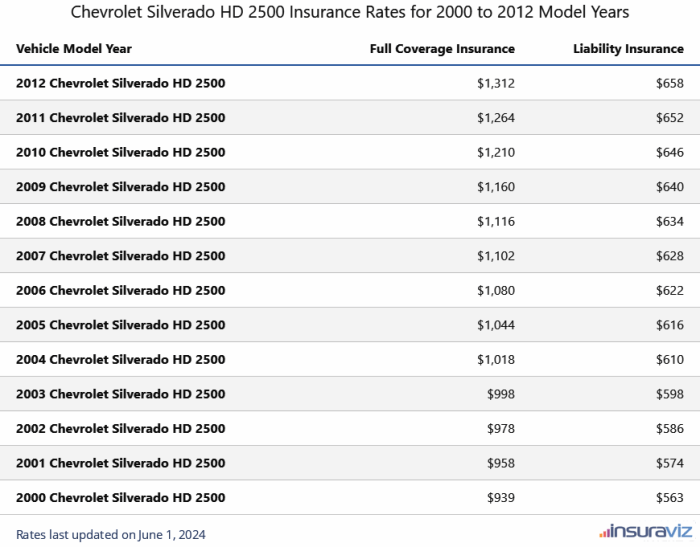

Estimated Insurance Premiums

The estimated insurance premium for a 2020 Chevy Silverado can range from $100 to $200 per month, depending on the driver’s age, driving history, and location. For example, a young driver with a clean driving record living in a rural area could pay around $100 per month for insurance. On the other hand, an older driver with a history of accidents living in a large city could pay around $200 per month for insurance.

Factors Influencing Insurance Premiums

Insurance premiums for a 2020 Chevy Silverado are influenced by various factors, including driving history, location, and coverage options. Understanding these factors can help drivers make informed decisions about their insurance policies and potentially lower their premiums.

Driving History

Driving history is a major factor in determining insurance premiums. Drivers with clean driving records, no recent accidents or traffic violations, are typically eligible for lower premiums. On the other hand, drivers with poor driving histories, such as those with multiple accidents or speeding tickets, may face higher premiums.

In addition, it’s essential to consider the potential cost of insurance for your new vehicle. To ensure you’re getting the best coverage for your needs, it’s wise to consult with a car insurance attorney. They can help you understand your options and negotiate a fair price for your insurance policy.

This can give you peace of mind knowing that you’re adequately protected financially in the event of an accident.

Location

The location where a vehicle is registered and primarily driven can also impact insurance premiums. Areas with higher rates of accidents, theft, or vandalism typically have higher insurance rates. Additionally, urban areas tend to have higher premiums than rural areas due to increased traffic congestion and the potential for accidents.

To determine the estimated car payment insurance cost on a 2020 Chevy Silverado, it’s crucial to consider factors like your driving history and location. Additionally, exploring options like costco car insurance can provide competitive rates and valuable benefits. Understanding these variables and comparing quotes from reputable insurers will help you secure the most suitable and affordable insurance coverage for your 2020 Chevy Silverado.

Coverage Options

The type and amount of insurance coverage selected also affect premiums. Drivers who opt for higher levels of coverage, such as comprehensive and collision coverage, will generally pay more than those who choose only liability coverage. Additionally, higher deductibles can lower premiums, as they represent the amount the driver is responsible for paying out-of-pocket in the event of an accident.

Insurance Coverage Options

Insurance coverage for a 2020 Chevy Silverado is essential to protect yourself and your vehicle in case of an accident. There are various types of coverage available, each with its own benefits and limitations.

The most basic type of coverage is liability insurance, which is required by law in most states. Liability insurance covers damages to other people or their property if you are at fault in an accident. However, it does not cover damages to your own vehicle.

Collision coverage is an optional type of insurance that covers damages to your own vehicle if you are involved in an accident, regardless of who is at fault. Collision coverage is typically more expensive than liability insurance, but it can provide peace of mind in case of an accident.

Comprehensive coverage is another optional type of insurance that covers damages to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters. Comprehensive coverage is typically more expensive than collision coverage, but it can provide comprehensive protection for your vehicle.

Choosing the Right Coverage

The type of insurance coverage you choose will depend on your individual needs and budget. If you have a new or expensive vehicle, you may want to consider comprehensive coverage. If you have an older or less valuable vehicle, you may be able to get by with liability-only coverage.

The estimated car payment insurance cost for a 2020 Chevy Silverado can vary depending on factors such as your driving history and the level of coverage you choose. If you’re looking for a way to protect your financial future, consider exploring thrivent long-term care insurance.

This type of insurance can help cover the costs of long-term care, such as nursing home stays or assisted living. By planning ahead, you can ensure that you have the resources you need to maintain your independence and quality of life as you age.

Returning to the topic of car insurance, remember to compare quotes from multiple insurance companies to find the best rate for your 2020 Chevy Silverado.

It is important to shop around and compare quotes from different insurance companies before you make a decision. This will help you find the best coverage at the most affordable price.

The estimated car payment insurance cost for a 2020 Chevy Silverado can vary based on factors like your driving history and location. For instance, car insurance for a 2024 Toyota Corolla may have different rates in different states. However, understanding these costs can help you budget for your vehicle expenses.

Researching insurance options and comparing quotes from multiple providers is recommended to find the best coverage for your needs.

Methods for Reducing Costs: Estimated Car Payment Insurance Cost On 2020 Chevy Silverado

To minimize the financial burden of owning a 2020 Chevy Silverado, it is crucial to explore cost-saving strategies for both car payments and insurance premiums.

Several methods can effectively reduce expenses associated with your vehicle. These include taking advantage of discounts, negotiating payment plans, and implementing defensive driving techniques.

Discounts

Insurance companies offer a range of discounts to policyholders who meet certain criteria. These discounts can significantly lower premiums, making it essential to inquire about and qualify for as many as possible.

Understanding the estimated car payment insurance cost for a 2020 Chevy Silverado is essential. Factors like driving history and location impact the cost. However, considering open care insurance options can provide cost-effective coverage. Open care insurance offers flexible plans and competitive rates, potentially reducing your overall car payment insurance cost for your 2020 Chevy Silverado.

- Multi-car discount: Insuring multiple vehicles with the same company can qualify you for a discount.

- Good driver discount: Maintaining a clean driving record without accidents or violations can earn you a discount.

- Defensive driving course discount: Completing an approved defensive driving course can demonstrate your commitment to safe driving and lead to a discount.

Payment Plans

If the initial car payment is a concern, exploring flexible payment plans can provide relief. Dealerships often offer financing options with varying interest rates and loan terms.

- Extended loan terms: Opting for a longer loan term can reduce monthly payments but may result in higher interest charges over time.

- Refinancing: If interest rates have dropped since you purchased your Silverado, refinancing your loan can potentially secure a lower interest rate and reduce monthly payments.

Defensive Driving Techniques, Estimated car payment insurance cost on 2020 chevy silverado

Practicing defensive driving techniques can help you avoid accidents and traffic violations, which can positively impact your insurance premiums.

- Maintain a safe following distance: Leave ample space between your vehicle and the one in front to avoid rear-end collisions.

- Anticipate potential hazards: Scan the road ahead and be prepared to react to unexpected situations, such as pedestrians or vehicles entering the roadway.

- Avoid distractions: Refrain from using cell phones, texting, or engaging in other distracting activities while driving.

Comparison with Other Vehicles

The estimated car payment and insurance costs for a 2020 Chevy Silverado can vary compared to similar vehicles in its class. Several factors contribute to these differences, including the vehicle’s make, model, trim level, safety features, and the driver’s profile.

Generally, vehicles with higher purchase prices tend to have higher car payments and insurance premiums. Additionally, vehicles with more advanced safety features, such as lane departure warnings and automatic emergency braking, may qualify for lower insurance rates.

Comparison with Specific Vehicles

- Compared to the 2020 Ford F-150, the 2020 Chevy Silverado has a slightly higher estimated car payment but a lower estimated insurance premium.

- The 2020 Ram 1500 has a lower estimated car payment than the 2020 Chevy Silverado but a higher estimated insurance premium.

- The 2020 Toyota Tundra has a lower estimated car payment and a lower estimated insurance premium than the 2020 Chevy Silverado.

FAQ Corner

What factors influence the estimated car payment and insurance cost for a 2020 Chevy Silverado?

The estimated car payment and insurance cost for a 2020 Chevy Silverado can be influenced by factors such as the trim level, purchase price, financing terms, driving history, location, and coverage options.

How can I reduce the cost of my car payment and insurance premiums for a 2020 Chevy Silverado?

There are several ways to reduce the cost of your car payment and insurance premiums for a 2020 Chevy Silverado. These include shopping around for the best rates, taking advantage of discounts, and increasing your deductible.

What types of insurance coverage are available for a 2020 Chevy Silverado?

There are several types of insurance coverage available for a 2020 Chevy Silverado, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.