Thrivent long-term care insurance offers a lifeline of support for individuals and families navigating the challenges of aging and the potential need for extended care. This guide delves into the intricacies of Thrivent’s offerings, empowering readers with the knowledge to make informed decisions about their long-term care planning.

From understanding the various coverage options and eligibility requirements to navigating the claims process and maximizing benefits utilization, this comprehensive resource provides a roadmap to securing financial protection and peace of mind in the face of life’s uncertainties.

Benefits and Coverage of Thrivent Long-Term Care Insurance

Thrivent long-term care insurance offers various coverage options to meet different care needs and financial situations. The benefits and coverage included in each plan may vary, but generally, they provide financial assistance for long-term care expenses, such as assisted living, nursing home care, and home health care.

To be eligible for coverage, individuals must meet certain requirements, including being a U.S. resident, aged 18 or older, and able to perform two or more activities of daily living (ADLs) independently. ADLs include bathing, dressing, eating, toileting, and transferring.

Types of Coverage

- Comprehensive Coverage: This plan provides the most extensive coverage, including benefits for both skilled and custodial care. Skilled care refers to services provided by licensed healthcare professionals, such as nurses and physical therapists, while custodial care covers assistance with daily activities, such as bathing and dressing.

- Traditional Coverage: This plan offers coverage for skilled care only, which is typically more expensive than custodial care. It is a suitable option for individuals who are more likely to need skilled nursing care.

- Home Health Care Coverage: This plan provides coverage for home health care services, such as nursing, therapy, and personal care. It is a good option for individuals who prefer to receive care in the comfort of their own homes.

Benefits Included, Thrivent long-term care insurance

- Daily Benefit Amount: The amount of daily coverage provided for long-term care expenses. This amount can range from $50 to $300 per day, depending on the plan.

- Benefit Period: The maximum number of days or years for which benefits are available. This can range from two years to unlimited, depending on the plan.

- Elimination Period: The waiting period before benefits begin. This can range from 0 to 100 days, depending on the plan.

- Inflation Protection: A feature that automatically increases the daily benefit amount over time to keep pace with inflation.

- Waiver of Premium: A provision that waives premium payments if the insured becomes unable to perform two or more ADLs.

Cost and Premiums of Thrivent Long-Term Care Insurance

The cost of Thrivent long-term care insurance premiums is influenced by several factors, including age, health, gender, coverage amount, and benefit period. Younger and healthier individuals typically pay lower premiums than older and less healthy individuals. Women also tend to pay higher premiums than men due to their longer life expectancy.

Thrivent offers a variety of premium payment options, including monthly, quarterly, semi-annually, and annually. Policyholders can choose the payment option that best fits their budget and needs.

Tax Benefits

Premiums paid for long-term care insurance may be eligible for tax deductions. The amount of the deduction varies depending on the individual’s age and income. Consult with a tax professional for more information on the tax benefits associated with long-term care insurance.

Claims Process and Benefits Utilization

Filing a claim with Thrivent long-term care insurance is a straightforward process. Policyholders can initiate a claim by contacting Thrivent’s customer service department or submitting a claim form online. The claim form requires basic information about the policyholder, the reason for the claim, and the requested benefits.

Thrivent long-term care insurance offers peace of mind, ensuring financial protection for the costs associated with long-term care. With the rising costs of healthcare, insurance like Thrivent’s long-term care plan provides a valuable safety net. This specialized coverage can help individuals maintain their independence and dignity, while easing the financial burden on loved ones.

To support a claim, policyholders must provide documentation that verifies the need for long-term care services. This may include medical records, assessments from healthcare professionals, and proof of expenses incurred for care. Thrivent will review the submitted documentation and make a determination on the claim.

Options for Utilizing Benefits

Thrivent long-term care insurance benefits can be used in various ways to cover the costs of long-term care. Policyholders can choose to receive benefits as a monthly cash payment, which provides flexibility in how the funds are used. Alternatively, benefits can be used to pay for specific care services, such as home health care, assisted living, or nursing home care. Thrivent has a network of providers that policyholders can access for care services, but they are not limited to using only these providers.

Comparison with Other Long-Term Care Insurance Providers

Thrivent long-term care insurance stacks up favorably against offerings from other leading providers in the industry. To help you make an informed decision, we’ve compiled a comprehensive comparison table highlighting the key coverage, costs, and benefits of Thrivent’s plan in relation to its competitors.

Beyond the specifics Artikeld in the table, it’s important to consider the unique features and advantages that set Thrivent apart. These include:

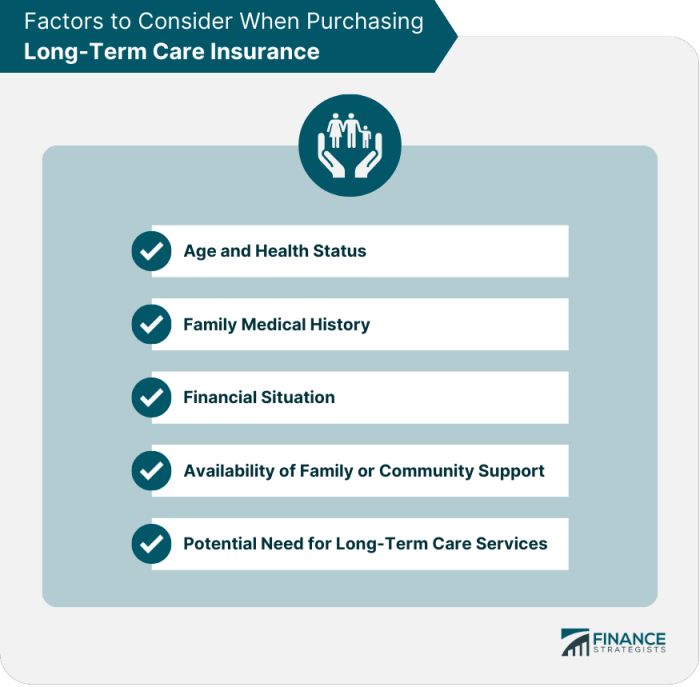

Factors to Consider When Choosing a Long-Term Care Insurance Provider

- Financial strength and stability: Look for providers with a strong track record and high financial ratings from independent agencies.

- Coverage options: Consider the range of coverage options available, including different benefit amounts, elimination periods, and riders.

- Cost: Compare premiums and other costs associated with different plans to find one that fits your budget.

- Customer service: Choose a provider with a reputation for excellent customer service and support.

- Reputation: Research the reputation of different providers by reading reviews and talking to others who have experience with them.

Case Studies and Testimonials

Thrivent long-term care insurance has made a significant difference in the lives of countless individuals and their families. Here are some real-life stories that showcase the benefits and impact of this valuable coverage.

These case studies and testimonials provide firsthand accounts of how Thrivent long-term care insurance has helped policyholders navigate the challenges of long-term care and maintain their financial security.

Case Study: The Smith Family

The Smith family was faced with a difficult decision when their elderly father, John, was diagnosed with Alzheimer’s disease. They knew that he would need extensive care, but they were worried about the financial burden it would place on their family.

Fortunately, John had purchased a Thrivent long-term care insurance policy years earlier. This coverage provided the Smiths with the financial resources they needed to pay for John’s care, allowing him to receive the best possible treatment in a comfortable and supportive environment.

Testimonial: Sarah Jones

“I am so grateful for the peace of mind that Thrivent long-term care insurance has given me. I know that if I ever need long-term care, I will have the financial resources to pay for it, without burdening my family.”

Sarah Jones, Thrivent long-term care insurance policyholder

Answers to Common Questions

What types of coverage does Thrivent long-term care insurance offer?

Thrivent offers a range of coverage options, including home health care, assisted living facility care, nursing home care, adult day care, and respite care.

How much do Thrivent long-term care insurance premiums cost?

Premiums vary depending on factors such as age, health, and coverage level. Contact a Thrivent representative for a personalized quote.

What is the process for filing a claim with Thrivent long-term care insurance?

To file a claim, contact Thrivent and provide documentation supporting your need for care. Thrivent will review your claim and determine the appropriate benefits.