Car insurance claim lawyers specialize in guiding individuals through the complexities of insurance claims, ensuring fair compensation and protecting their rights. Whether you’ve been involved in a minor fender bender or a major collision, understanding your options and navigating the claims process can be overwhelming. This comprehensive guide will empower you with the knowledge and strategies you need to maximize your claim and get the justice you deserve.

Types of Car Insurance Claims: Car Insurance Claim Lawyer

Car insurance claims cover a wide range of incidents that can damage or destroy your vehicle. These claims can be filed for a variety of reasons, including accidents, theft, vandalism, and natural disasters.

Filing a car insurance claim can be a daunting task, especially if you don’t speak the language. If you’re looking for assistance with car insurance in spanish , a car insurance claim lawyer can help you navigate the process and ensure you receive fair compensation.

They can also provide legal advice and representation if necessary.

There are different types of car insurance coverage available, each of which covers a specific set of risks. The most common types of coverage include:

Collision Coverage

Collision coverage pays for damage to your vehicle caused by a collision with another vehicle or object. This coverage is typically required by law in most states.

If your car has been declared a total loss, it’s important to understand who is entitled to the insurance check. In most cases, the check will be made out to the registered owner of the vehicle. However, there may be some exceptions to this rule.

For example, if you have a loan on your car, the lender may be entitled to the check. Or, if you were involved in an accident that was caused by another driver, the other driver’s insurance company may be responsible for paying the claim.

If you have any questions about who will receive the insurance check, it’s best to contact your insurance company directly. They can help you understand your policy and ensure that you receive the compensation you are entitled to. For more information on this topic, please refer to our article who gets the insurance check when a car is totaled.

Comprehensive Coverage

Comprehensive coverage pays for damage to your vehicle caused by events other than collisions, such as theft, vandalism, and natural disasters. This coverage is not required by law, but it is highly recommended.

Finding a reliable car insurance claim lawyer is essential, especially in areas like Amarillo, TX, where car insurance is a necessity. An experienced lawyer can help you navigate the complexities of insurance claims and ensure you receive fair compensation for your damages.

However, choosing the right lawyer is crucial to maximize your chances of success.

Liability Coverage

Liability coverage pays for injuries or damage to others caused by an accident involving your vehicle. This coverage is required by law in most states.

When filing a car insurance claim, it’s crucial to have an experienced lawyer on your side. If you’re in Buffalo, NY, consider consulting with a reputable attorney who can guide you through the process. For those seeking affordable car insurance options, cheap car insurance buffalo ny can provide valuable information and connect you with the best rates.

Remember, having a knowledgeable car insurance claim lawyer by your side can significantly improve your chances of a successful outcome.

How to File a Car Insurance Claim

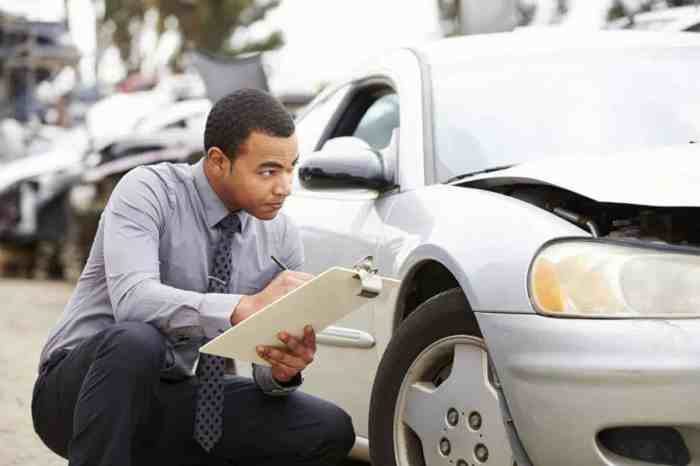

Filing a car insurance claim can be a stressful experience, but it’s important to know the steps involved to ensure a smooth process. Here’s a step-by-step guide to help you file a car insurance claim:

Contact Your Insurance Company

As soon as possible after the accident, contact your insurance company to report the claim. They will provide you with a claim number and instructions on how to proceed.

Gather Evidence

Take photos of the damage to your vehicle, the other vehicle(s) involved, and the accident scene. Get the names and contact information of any witnesses.

Complete a Claim Form

Your insurance company will provide you with a claim form to fill out. Be sure to provide accurate and detailed information about the accident, including the date, time, location, and a description of what happened.

Submit Your Claim, Car insurance claim lawyer

Once you have completed the claim form, submit it to your insurance company along with any supporting documentation, such as photos and witness statements.

Cooperate with the Insurance Company

Your insurance company will investigate your claim and may request additional information or documentation. Be cooperative and provide them with everything they need to process your claim.

Dealing with Insurance Companies

Effectively communicating with insurance companies is essential for a successful car insurance claim. It involves presenting your case clearly, being prepared for negotiations, and understanding the company’s perspective.

Being organized and prepared is crucial. Gather all relevant documentation, including the accident report, medical records, and estimates for repairs. This will help you present a strong case and support your claims.

Negotiations

Negotiations are an important part of the claims process. Be prepared to discuss your claim and be willing to compromise. However, it’s equally important to stand your ground and advocate for a fair settlement that covers your losses.

- Research industry benchmarks and comparable settlements to support your claim.

- Be prepared to provide evidence to back up your demands, such as medical bills or repair estimates.

- Stay professional and respectful during negotiations, even if disagreements arise.

Hiring a Car Insurance Claim Lawyer

Hiring a car insurance claim lawyer can provide several benefits, including:

- Expertise in insurance law and claims processes

- Negotiating skills to maximize your settlement

- Representation in court if necessary

Finding and Evaluating a Lawyer

To find and evaluate a lawyer, consider the following steps:

- Get referrals: Ask friends, family, or other professionals for recommendations.

- Research online: Search online directories and read reviews to identify potential lawyers.

- Interview lawyers: Meet with several lawyers to discuss your case and their experience.

- Check credentials: Verify the lawyer’s license, education, and experience in car insurance law.

- Consider fees: Discuss the lawyer’s fee structure and any potential costs.

Query Resolution

What are the common types of car insurance claims?

Common types of car insurance claims include property damage, bodily injury, collision, comprehensive, and uninsured/underinsured motorist coverage.

How do I file a car insurance claim?

To file a car insurance claim, contact your insurance company promptly, gather evidence and documentation, and follow their specific instructions for submitting a claim.

When should I consider hiring a car insurance claim lawyer?

Consider hiring a car insurance claim lawyer if your claim is complex, involves significant damages or injuries, or if you’re facing disputes with the insurance company.

Car insurance claim lawyers specialize in representing individuals and businesses in legal matters related to car insurance claims. They provide guidance on navigating the complex legal process and ensure that their clients receive fair compensation for their losses. If you’re considering a career in the insurance industry, exploring property-casualty insurers can provide valuable insights.

This field offers opportunities for car insurance claim lawyers to apply their legal expertise in a specialized area of insurance law.